Equity Becomes Cash

Turn your home's equity into cash without selling your property. Enjoy a quick, straightforward process that gives you access to funds when you need them.

Use your home's equity to pay off debt, upgrade your space, or cover major expenses through a quick and easy process.

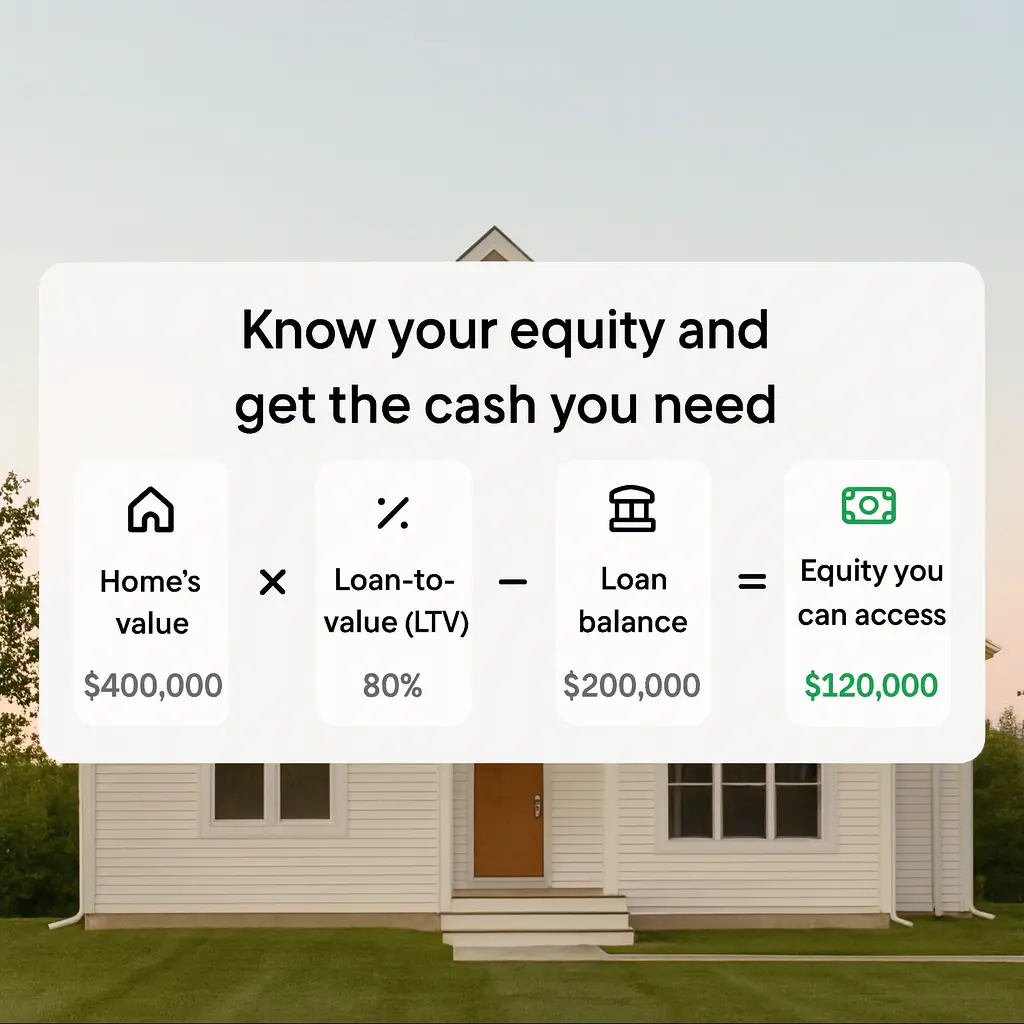

Leverage your home equity to get cash for your needs. Your equity — the difference between your home's value and your mortgage — can help you reach your goals

Turn your home's equity into cash without selling your property. Enjoy a quick, straightforward process that gives you access to funds when you need them.

Replace high-interest debt with a lower mortgage rate to cut monthly payments and save money long term.

Simplify your finances with one single, manageable monthly mortgage payment instead of multiple separate loans.

Unlock opportunities using your home equity:

We're here to answer your questions about cash-out refinancing. Our experts can guide you through every step.

A Cash-Out Refi (Access Your Equity) might be right if you: have equity in your home that you want to access as cash, want a lower interest rate on your mortgage payments, want to consolidate high-interest debt, or plan to use the cash for a purpose that adds long-term value.

A Cash-Out Refi (Access Your Equity) replaces your current mortgage with a larger loan. The difference between the new loan and your old mortgage balance is given to you in cash. You'll make one monthly payment on the new, larger mortgage.

These terms are often used interchangeably. Both refer to refinancing your mortgage for more than you owe and receiving the difference in cash. The key is that you're replacing your existing mortgage with a new one.

You can use the cash for virtually anything: home improvements, debt consolidation, education expenses, starting a business, emergency expenses, or investment opportunities. However, using it for purposes that increase your home's value or improve your financial situation is generally recommended.

Closing costs typically range from 2% to 5% of the loan amount and may include: appraisal fees, origination fees, title insurance, credit report fees, and other standard mortgage closing costs. Some lenders offer options to roll these costs into your loan.